If you purchased your home more than two years ago or your house was a new-build and one of the following scenarios applies to you, you may be a great candidate for refinancing your home.

- Have high-interest debt

- Would like to lower your monthly bills

- Want a better interest rate

- Want to access cash for any reason at all – Personal reasons, renovations, investments, emergency fund, or to purchase another property.

- Want to remove somebody off your mortgage and title. Spouse/divorce, Co-signer, or anybody else.

- Coming up for renewal

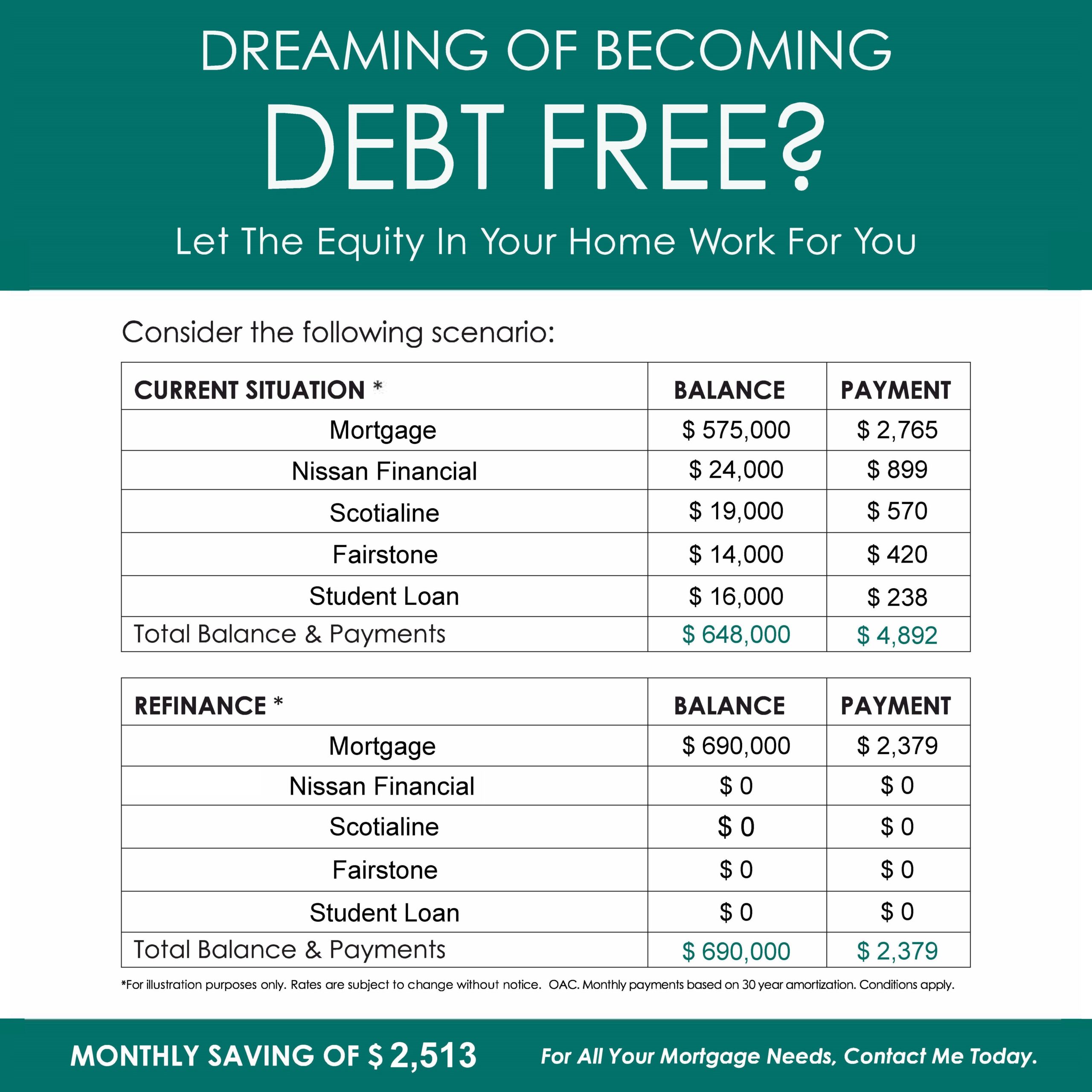

Refinance to consolidate debts and take out equity

Refinancing your home can be an excellent way to fund a major renovation, purchase a second property, purchase a rental property, or simply access your cash.

This is an example of refinancing to access equity.

Value of your home: $600,000.00 refinanced at 80% loan-to-value.

Total Mortgage: $480,000.00

Pay off existing mortgage: $300,000.00

Approximate Lawyer Cost: $1,000.00

Approximate cash paid to you: $179,000.00

Monthly Payment: This will be based on your credit and overall application.

There are many different reasons to refinance your property so we couldn’t include

every scenario in this post. If you think that you may benefit from refinancing and would like

some additional information, please contact us now.